US markets ended up in the green with a strong push despite Fed gunning for a two consecutive rate hike. It seems that nothing can stop this rally! Its good news for us of course as we are already positioned in the market. BUT of course, we would like to add more shares in. For those who haven’t gotten in due to all the fearmongers out there. One way is to start dollar cost average. We’ve been bullish since the start of the year and have been updating as much as possible but if all else fails, then star your dollar cost average as soon. YES, it may seem high now but what if market moves up to 4800 by year end? Can you afford to miss that??

Once again, we’ll update more in our upcoming webinar this coming Wednesday. Don’t miss it as we got lots of important stuff to go through. You can sign up over HERE .

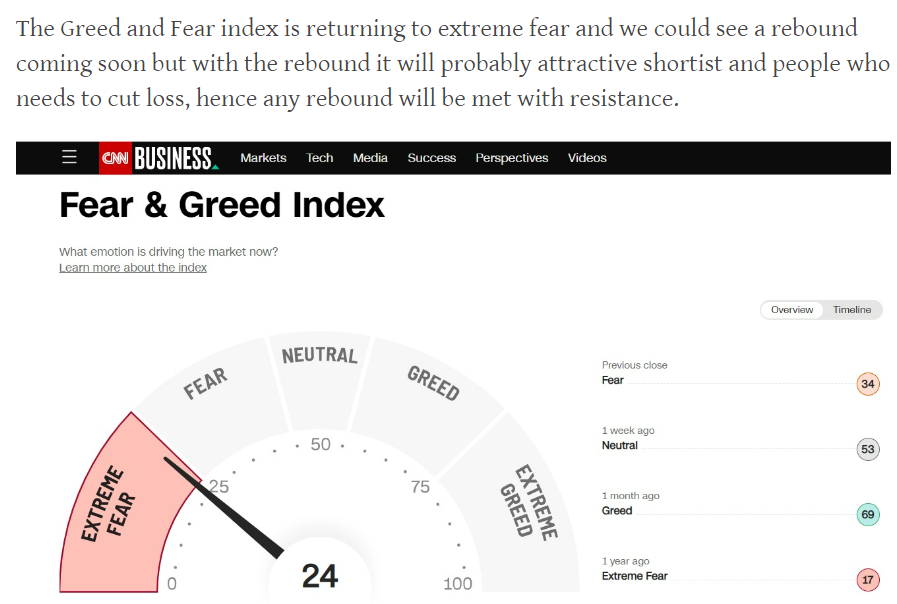

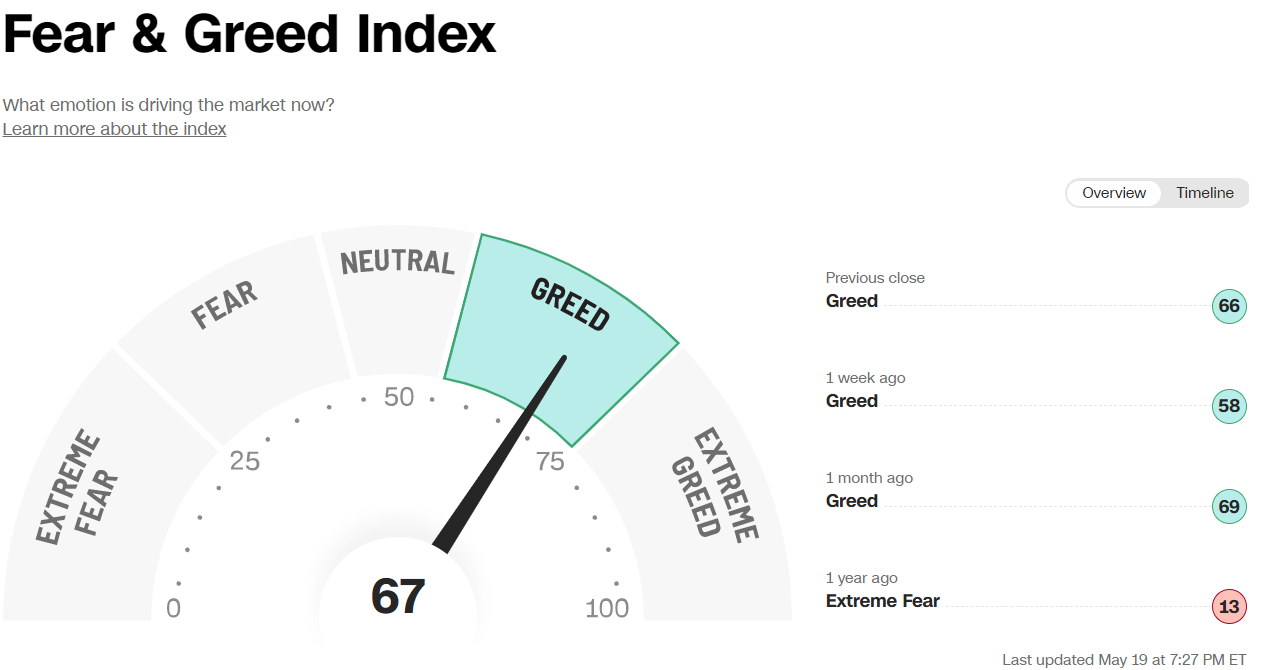

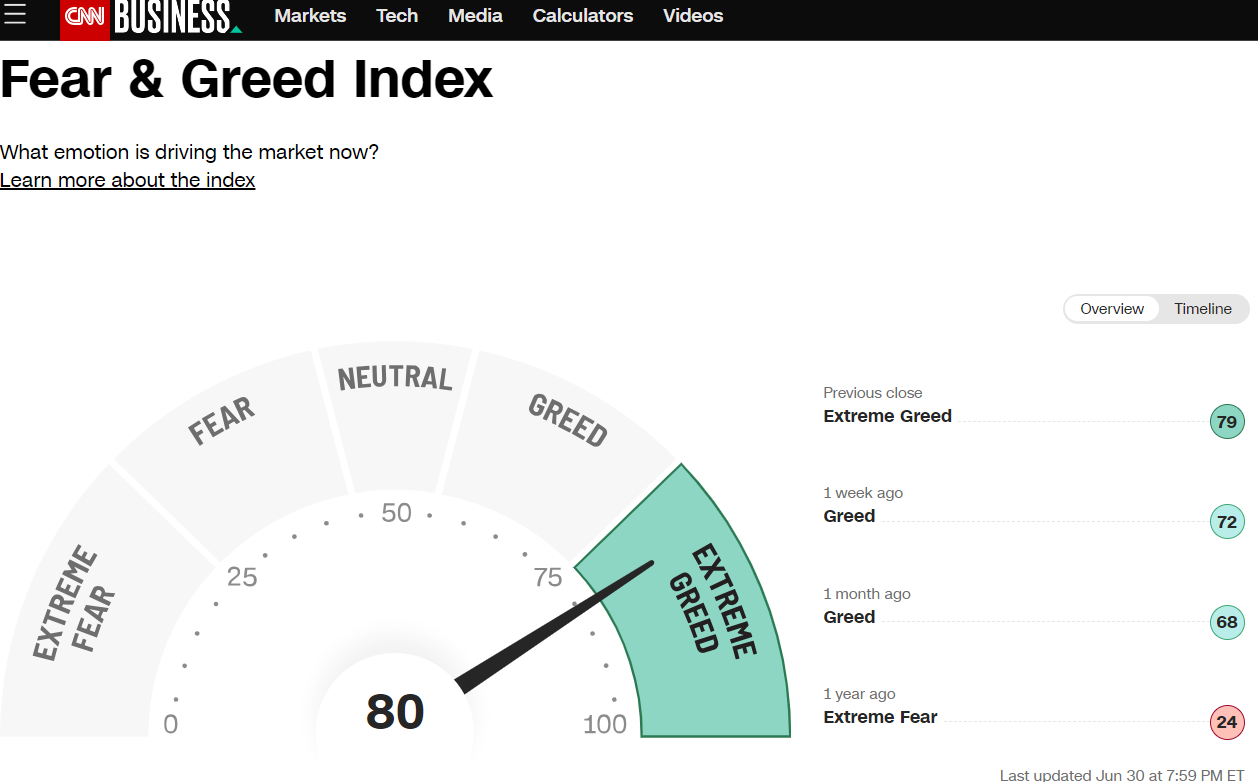

source: https://edition.cnn.com/markets/fear-and-greedSource:

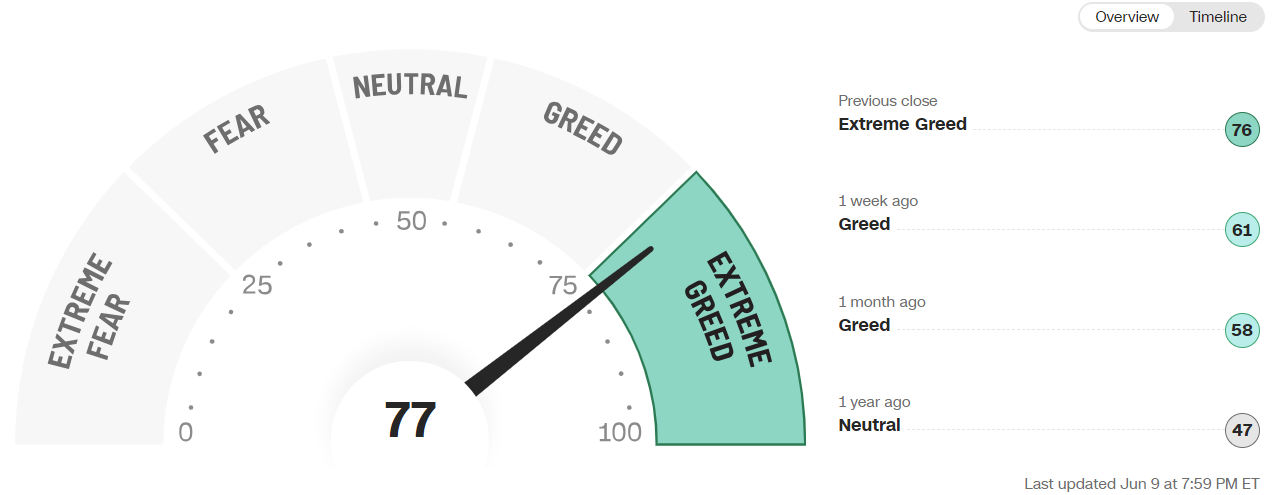

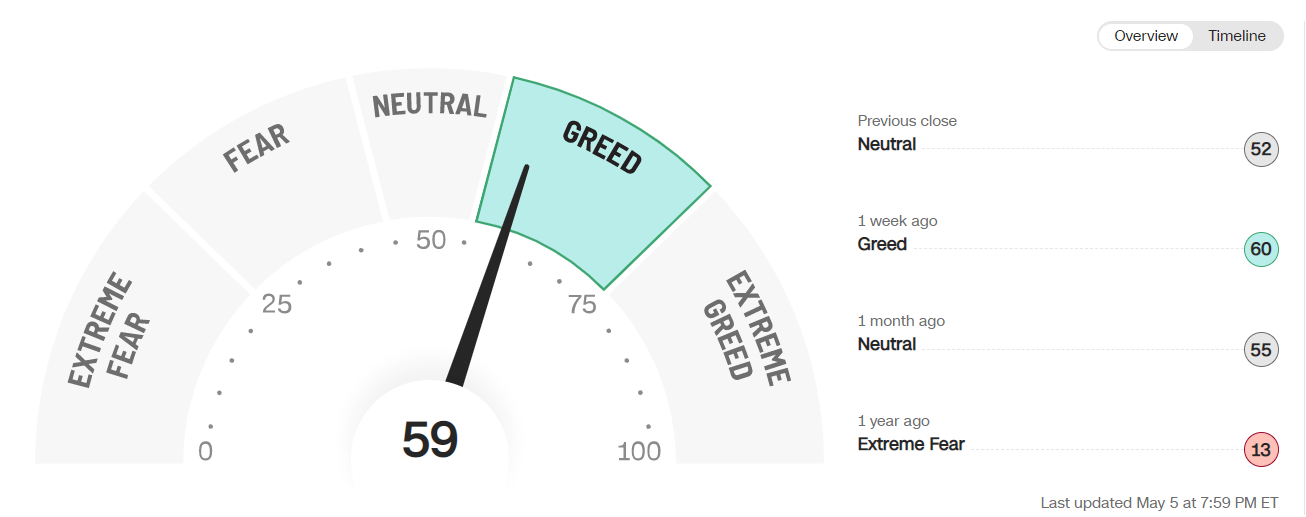

source: https://edition.cnn.com/markets/fear-and-greedSource:

The greed and fear index is currently into the extreme greed. If you ask me to enter the US markets now i would be hesitant. When it was in extreme fear back in march that’s when we entered the markets. So for now, we wouldn’t mind waiting for a lower entry.

Still lost on what to do with the markets? Let’s chat more this coming Wednesday in our webinar.

So what to look out for this week? Its a shorter week for US as they celebrate Independence day on 4th July. Fed minute meeting will be out this week. Other than that nothing really exciting for the markets yet.

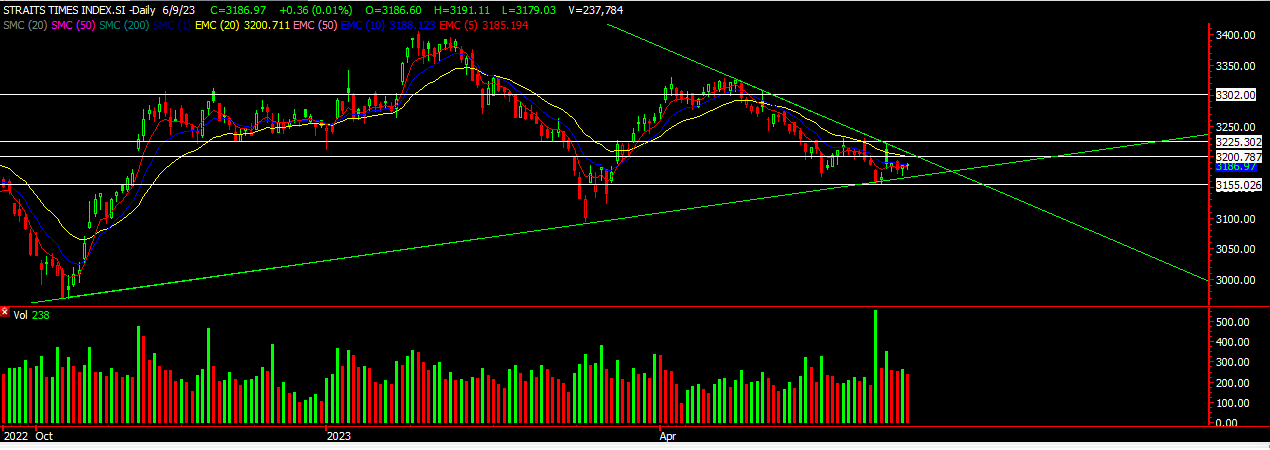

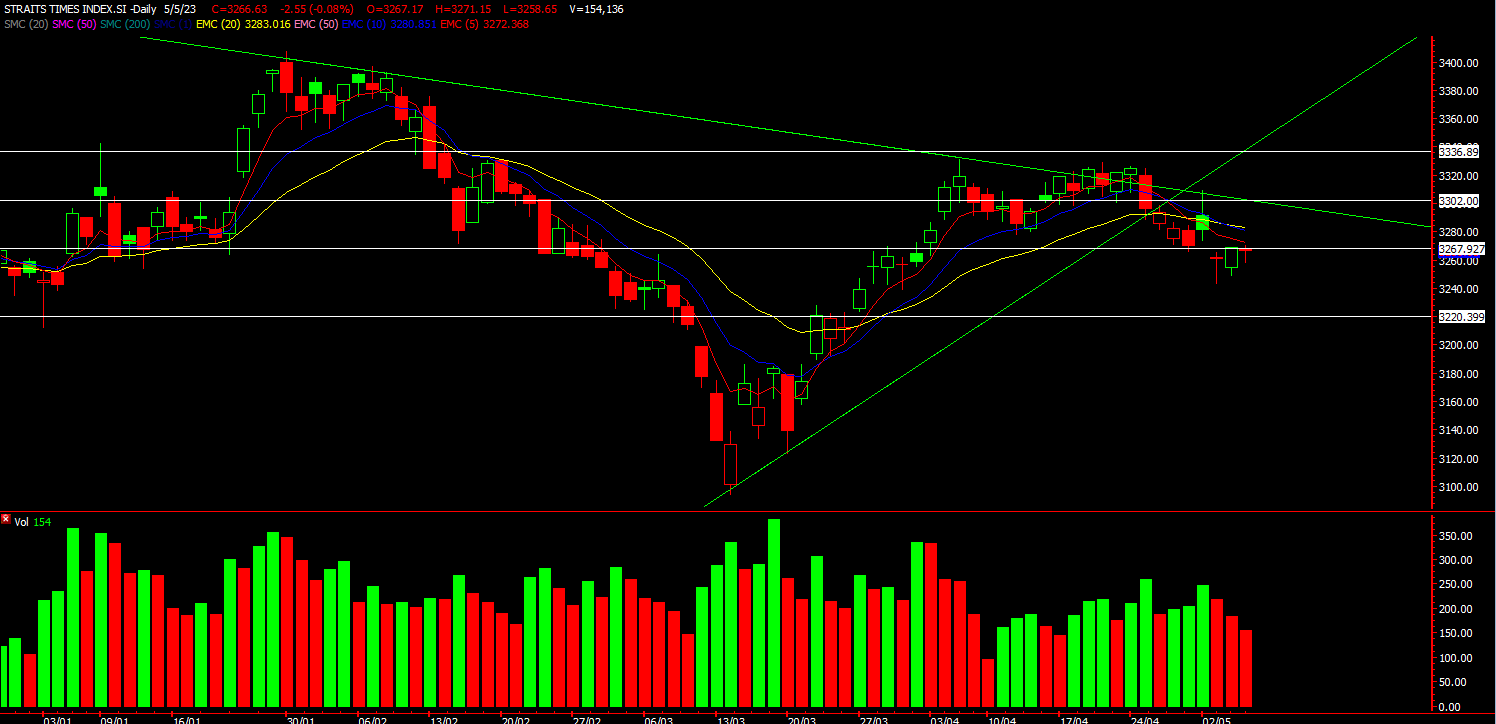

STI

Chart Source: DZH International Advisors 2nd July 2023

STI showed some resilience through the week and remain supported at that uptrend support line of 3186. For this week, with the positive sentiment of the US, we might see an attempt to move up to the 3249 level first. STI is looking like a sideways consolidation with any of its underlying blue chips not really going anywhere. SIA saw a big gap down on Temasek sold some of its stake on Friday. Importance of not chasing when the price has risen too much. June holidays are over, with the next half of the year starting, we should see the market start picking up as traders come back from their leave.

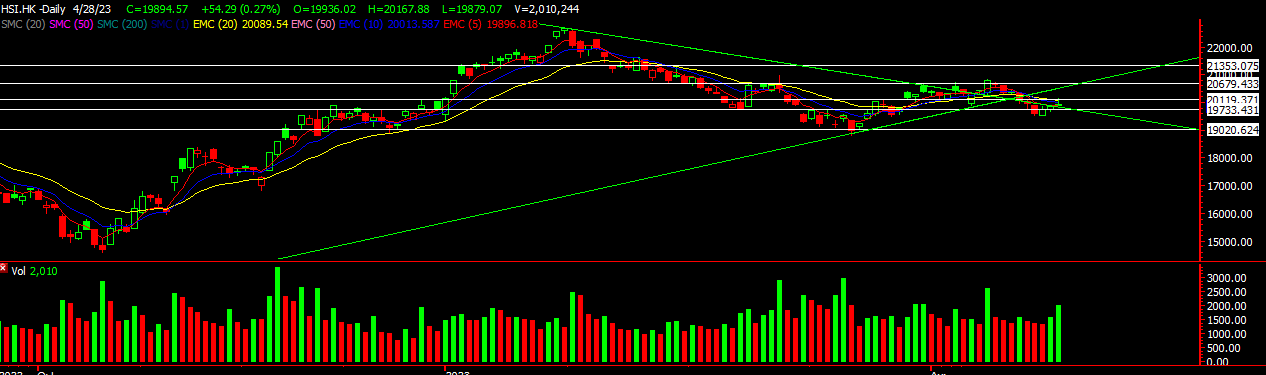

HSI

Chart Source: DZH International Advisors 2nd July 2023

HSI was a in sideways movement for the whole of last week. Critical support remains at 18522. China’s caixin PMI data will be out on Monday morning. This could set the tone for the week. A weaker data could spur more stimulus down the road and a stronger one might give some hope that China’s market is starting to get back on track. Overall, we need more stimulus for the HSI to move which is currently lacking. After the initial wave of stimulus, HSI has gone flat is awaiting more action.

Head over to our Facebook page for updates on the US markets as we are seeing more moves over there.

Yours

Humbly

Kelwin & Roy