ComfortDelgro – [ Are You Riding The Recovery Wave? What Else is Causing A Spike? ]

Just last Friday Evening ( 13th Aug) ComfortDelgro reported its earnings of $91 million, versus a net loss of $6.6 million the previous year. Revenue in the same period was up 13.6% y-o-y to $1.74 billion, with growth seen across its various segments ranging from taxis to bus operations.

The pandemic took a toll on many sectors like transport, hospitality , retail reits but as we continue to adapt these stocks are slowly coming back. With Singapore vaccine rate at 75% now, more and more areas are being open up and our economy is starting to get back on track.

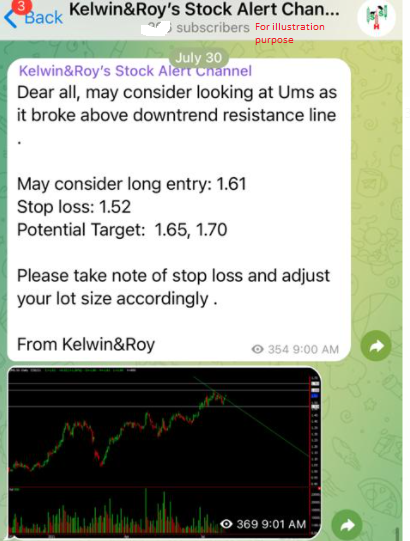

Not only that, ComfortDelgro is seeking an IPO listing in Australia for its Australian subsidiary which also gave the stock price a boost hitting our first target price in just 2 trading days. Where to now? From the chart below , our resistance is drawn at $1.71 then 1.76, will update more if those targets are hit. Volume is one of the biggest for the past few months and this might help sustain an up move in the coming days.

Chart Source: AdvisorXs 16th Aug 2021

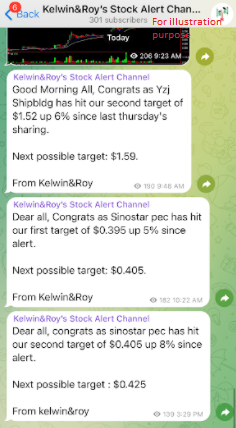

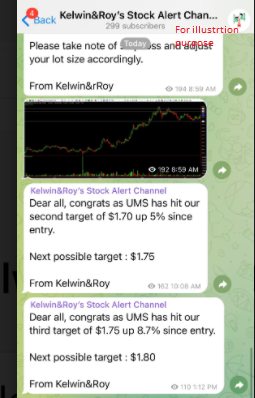

ComfortDelgro as been kind to us for the last few months as we caught a nice up wave for it.

Want such trade alert sent to your handphone straight? Want to join a growing pool of community of like minded traders?

Want to know what stock we’re looking at next?

Be our EXCLUSIVE CLIENT and be alerted earlier to not miss out!

Yours

Humbly

Kelwin&Roy