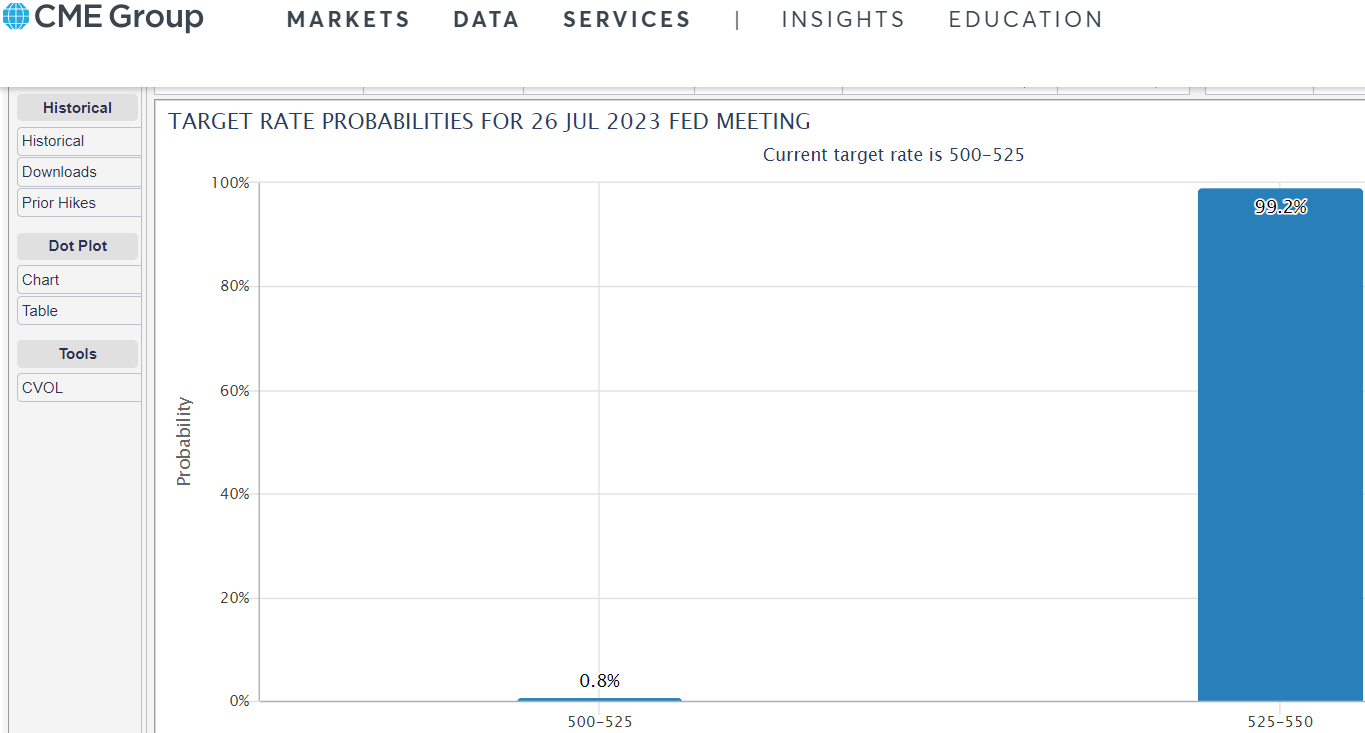

US market ended up for the week after PCE and unemployment data. We can see that the momentum of the market is starting to slow down and market doesn’t run too much on. We are in the month of Sept and seasonally this is a weaker month BUT there could still be a chance of it ending up and TAKE THIS CHANCE TO ADD SHARES IF YOU MISSED OUT PREVIOUSLY. For the month of Sept, Fed meeting would be one key event to look at. Market is widely anticipating Fed not to increase this round as inflation is showing signs of slow down and economy is also slow down. This could in turn bring a pause in rates which could bring another rally for the markets. =)

STI

The Straits Times Index rebound to our target of around 3230 level and currently being resisted. For the week ahead, we could see it break this resistance. Blue chip stock like Keppel Corp, SATS looks poised for a breakout. We’re targeting about 3295 for the next week or so as stocks are showing signs of rebound. We managed to catch the rebound in the banks which we mentioned TWO WEEKS back!

HSI

Hang Seng Index had a shorter week due to typhoon saola which shut the HK market down on friday. We were expecting resistance when HK went to 18522 our target, true enough we saw a pullback from the HK market. It is now currently at the 5ema support. We could see it consolidate over here with the downside support at 18053 and the resistance at 18522. After that we could see it move up to 18814 level at the gap resistance. Proceed with caution for the HK market as the market needs time to resolve its slowing economy and one way is through a big STIMULUS from the China Govt before it can really take off.

Proceed to our FACEBOOK for US markets!

Yours

Humbly

Kelwin & Roy