CPI data which market was eyeing turned out lower than expected last week which sent markets on an upwards swing. Despite Initial jobless claim coming in higher than expected, inflation data took center stage as more signs of easing ease inflation fears.

Also, big banks like JPMorgan, Citigroup and Wells Fargo all beat expectation which gave a boost to the markets too.

This week, focus will continue to be on earnings. Corporate results and outlooks will be taking on added importance especially during this season as investors will gauge whether all this interest rate hike is hurting earnings and spending. Consumer discretionary sector stocks like Tesla , J&J , Goldman Sachs are just a few big companies reporting next week and market will take cue from these earnings.

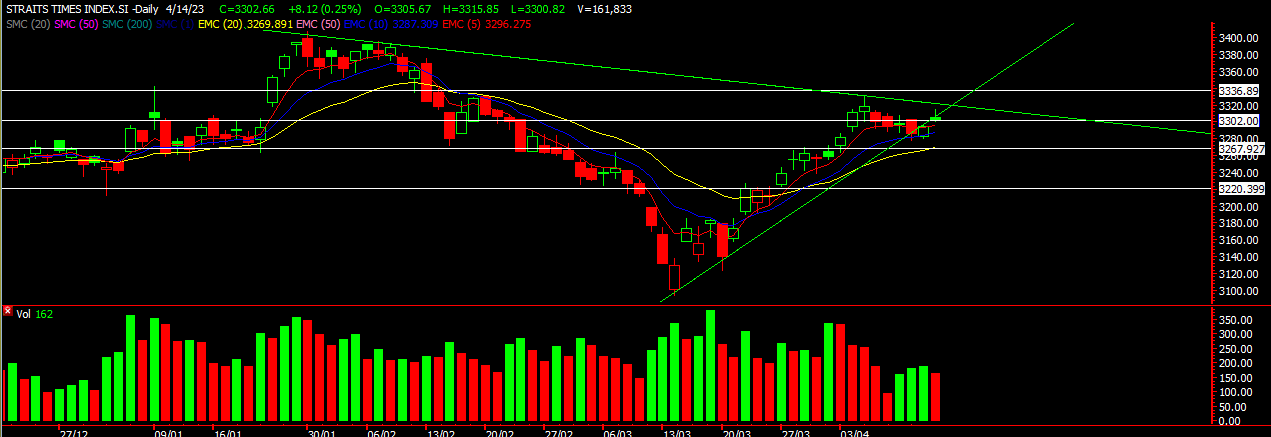

STI

Source: DZH International Advisors 16th April 2023

STI came off during the start of the week as expected but as CPI data came out, market start creeping up BUT started showing weakness on Friday as profit taking set in. For this week, expecting a drift down first to a test of the 20ema of now at 3270. Stocks in the STI components also looks tired, stocks like Sembcorp Industries, SGX and the banks too. So waiting for more pullback before entering. OR, one can considering a quick short to take advantage of the pullback.

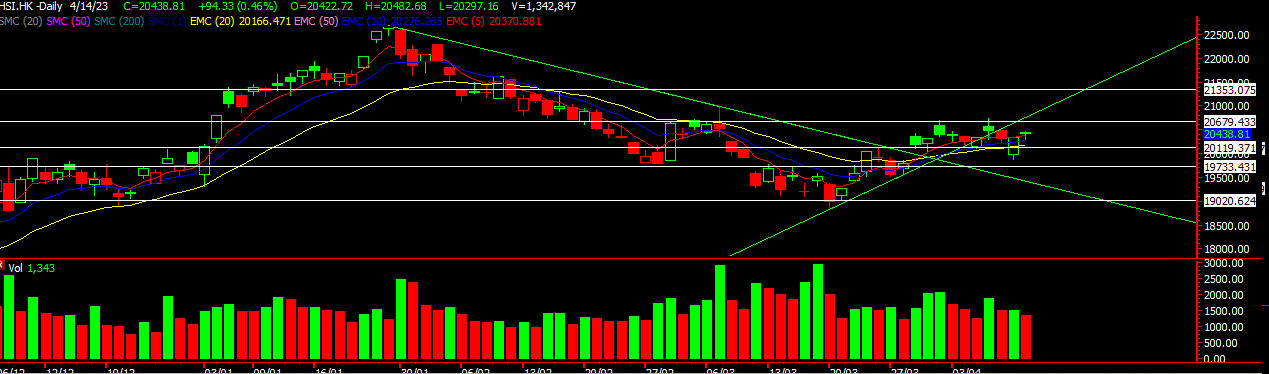

HSI

Source: DZH International Advisors 16th April 2023

HSI also having a sideways consolidation for now but has closed above the 5ema which is a positive sign for now. We should be looking at more upside for this week given the rebound on Friday. Upside to 20700 first which is also around that uptrend line resistance. Geely, Xiaomi are some of the stocks we’re looking at for this week for more upside. Overall, sentiments flowing from US will help to determine the direction for HSI too.

Head over to our Facebook to find out more about view on the US markets.

Yours

Humbly

Kelwin & Roy