Phillip Securities Enhanced Market Depth Seminar – [Opportunity to enhance your trading]

What is market depth?

Ever heard of your peers mentioning how they see the stacking of the buy and sell queue of a stock at different price levels. Or how some traders monitor closely the addition and subtraction of orders on a stock’s market depth ?

Market depth or Queue track displays the number of Buy orders and Sell orders of each price level of a particular listed stock, up to 20 levels of pending orders on each Buy and Sell side.

Want to know how to make sense of it?

Phillip Securities is the first broking house to offer the enhanced market depth that shows the number of individual orders at every price level. With this, one would know how many unique orders are there at every price level and this could help determine the forces behind each price level

For a limited time from 2 April to 29 June, we are offering this SGX Enhanced Market Depth for FREE!!

Want to know more on how this enhanced market depth can help you in your trading?

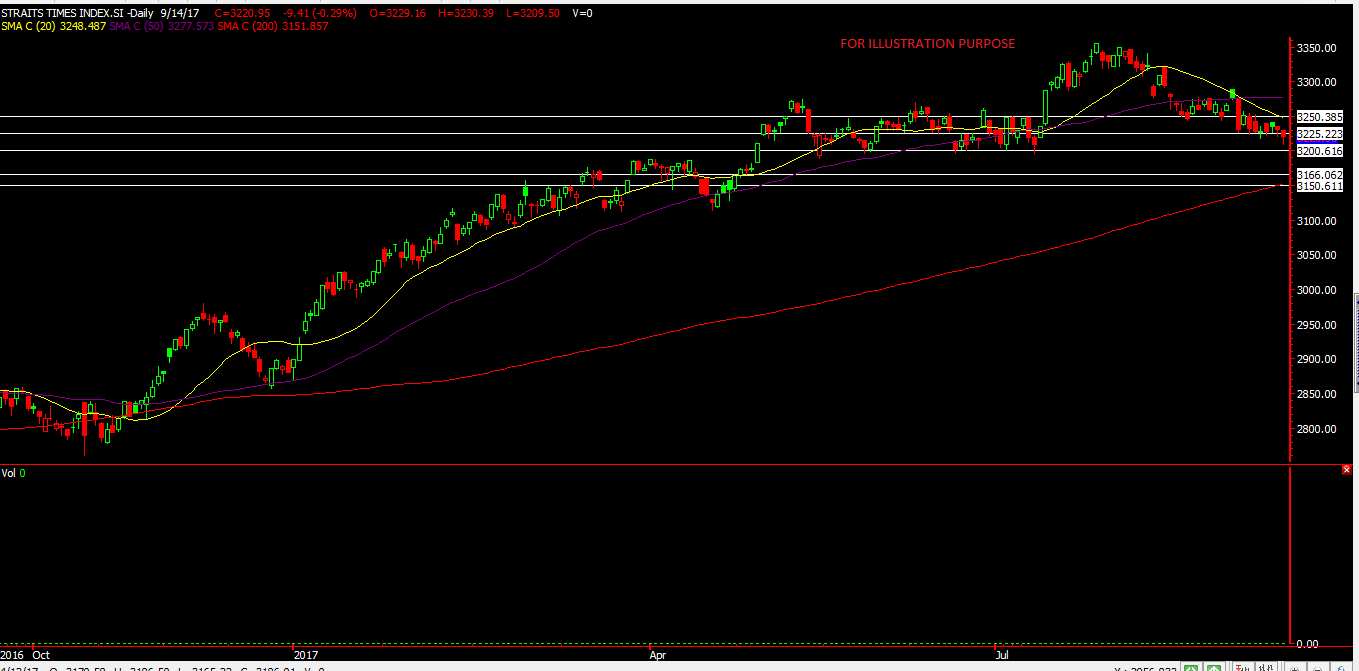

Then our Upcoming Seminar is for you. Not only will we share how to use the enhanced market depth, we will also be going through our strategies and how to integrate market depth with simple technical analysis with our recent ideas such as Hi-p, Olam, St Engineering , UMS, YZJ and many others .

Mark 24th April down as there are limited seats available!

Don’t miss out on this rare opportunity to be coached by Phillip Top Tier Remisiers Kelwin&Roy.

Register at this link below Right Now and See you on 24th April .

https://www.eventbrite.sg/e/trading-success-identify-stocks-with-a-winning-edge-tickets-45068348644

Regards

Kelwin&Roy