Sembcorp Industries – [ Pushing Upwards, Looking For A Further Break ]

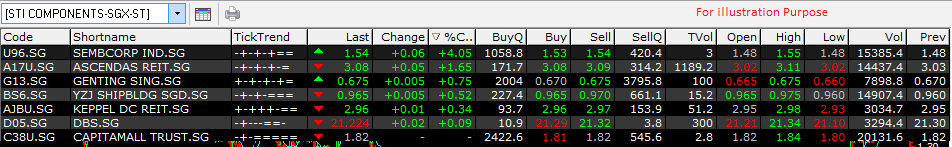

Chart Source: Poemsview 13th Jan 2021

Sembcorp Industries bucking the overall down day in the STI to come up as one of the top gainers yesterday.

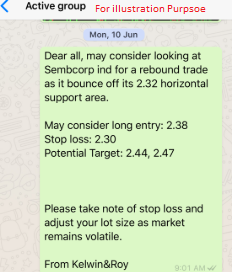

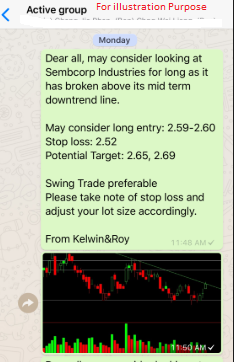

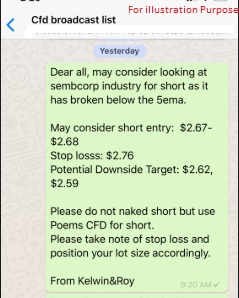

Will the trend continue? Lets take a look from a technical perspective. Sembcorp Industries had a month long consolidation from Dec till Jan and started to show sign of bullishness . In fact when it broke above the 20ema together with an increase in volume just last Wednesday we saw it as a bullish sign and alerted our EXCLUSIVE CLIENTS. The breakout was at $1.74 and since then we saw a nice upside of over 5% in a week. Does it still have legs to move up? We think its possible for it to test the $1.88 resistance then maybe a short break and try to push further to the $1.94 level which you’ll need to zoom out of the chart to have a better look. We’ve been covering Sembcorp Industries since last Oct so take a read over here to gain more knowledge about it.

Want to cut through the noise and get such trade alerts straight to your handphone?

Then be our EXCLUSIVE CLIENT and find out how much value is waiting for you!

See you onboard soon!

Yours

Humbly

Kelwin&Roy