OCBC – [ Sector Rotation, Cyclical Sectors Benefiting]

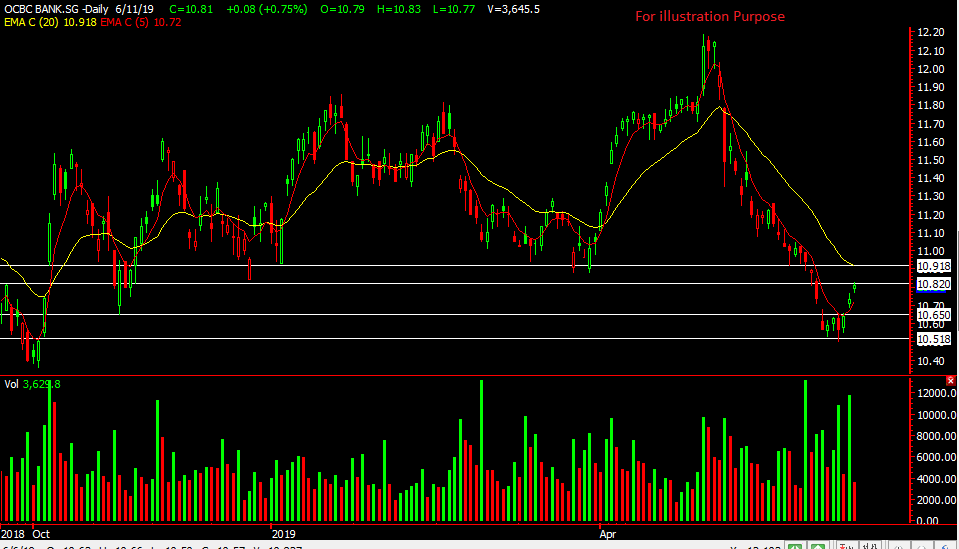

Chart Source: Poemsview 11th Nov 2020

OCBC along with the other two banks saw a surge in price over the last few days and even before the election results were out. As these three banks make up quite a heavy component of the STI, it was no surprise that we saw the STI trending up the last few days too.

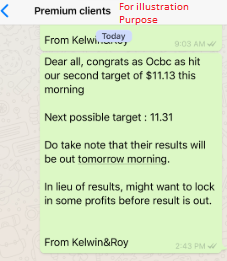

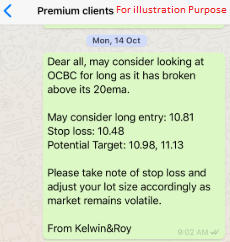

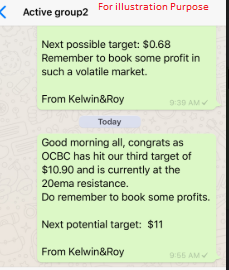

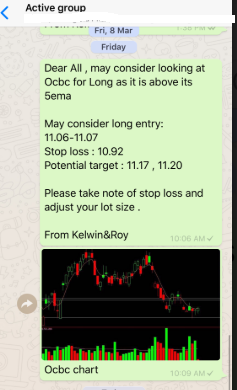

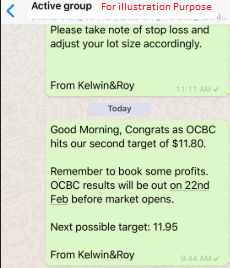

We wanted to be prudent and wait for results to be out before entering the market as we never know what may happen and anticipating results could result in being a hero or zero! As OCBC showed signs of interest and life on monday we alerted our EXCLUSIVE CLIENTS on this trade analysis and we’re glad OCBC gave us a favourable run. From our alert of $9, it has ran up to $9.58 which is more than 6% in three days!

From a technical perspective , OCBC has ran up for about 5 days and today’s volume has started to decrease. Some possible scenarios, we might see it push higher to our next target of around $9.84 which is also the gap resistance in the next couple of days. Optimism on vaccine news has funds flowing to the more cyclical sectors on hopes of recovery. It could also take a break as it ran up quite a bit so having a break is a positive thing. We’ll prefer for a retracement before looking at it again.

Want to cut through the noise and get such trade alerts straight to your handphone?

Then be our EXCLUSIVE CLIENT and find out how much value is waiting for you!

See you onboard soon!

Yours

Humbly

Kelwin&Roy