Another week up for markets as we saw the HK market came to life after Ant’s crackdown has ended. US markets also performed well after inflation data came in softer than expected. Overall, positive sentiments continue to flow and many of our HK and SG selections are all giving us good returns.

For this week, there are three key events to look out for.

- Its Earnings time. Second quarter earnings season gets underway as major banks started reporting last week. Expectations are low going into earnings and with earning beat we might see market moving up. Tesla will be one of the Mag 7 reporting its results on Wed! Head over here to look out for your company that are reporting. Remember, if you’re holding great companies for the long term then going into earnings wouldn’t be too much of a concern. BUT for those trading short term, holding over results is always a risky plan and its not something we would like to do.

- China economic data. China’s GDP Data will be coming out on Monday and any slow down might give rise to hopes of a stimulus from the Chinese govt. Gross domestic product is expected to have grown by an annualized 7.3% in the three months to June, compared with growth of 4.5% in the first quarter. Industrial production will also be out.

- US core retail sales (MOM) expecting a rise in that from 0.1 to 0.3%

We did see some profit taking coming in on Friday which is perfectly normal given such a strong run.

STI

As mentioned last week, we were expecting a rebound for the Straits Times Index and rebound it came! Pleasantly surprised with the strength as we saw banks being scooped up after being smashed down. We can see that STI being resisted by that downtrend line. We do think that the market might break it and test the 3300 resistance level. Many blue chip stocks are seeing a nice rebound for last week. SATS, SGX, Capitalland invest are all doing well. Special mention for Seatrium which saw a 18% move just for the week. Glad we caught this move too!

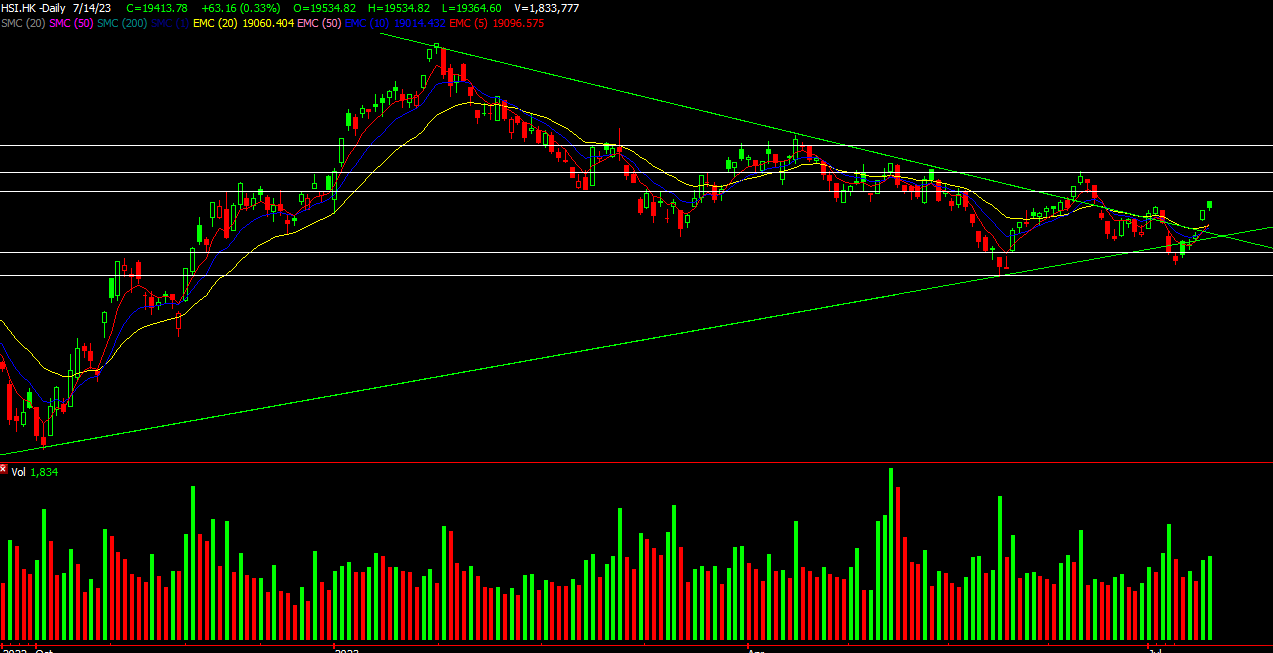

HSI

Short covering and bargain hunting stay the tone for last week as we saw the hang seng index roaring back. Tech stocks like baidu, tencent and ALIBABA all saw nice returns for the week. During such run, using DLCs could potentially upsize your profits! For this week, momentum could still carry on and we could be looking to test the 20k mark once again. There is heavy resistance there and it needs to build a base before taking it out. China data could provide some boost too. Don’t miss out on this rally and we hope you got in for some long term positions on the hong kong market.

Head over to our facebook for more updates and levels to look out for for the S&P500 and Nasdaq100.

Yours

Humbly

Kelwin & Roy