17th September, 2018, 2:37 PM

Chart Source: Poemsview 17th Sept 2018

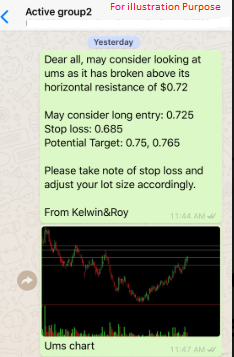

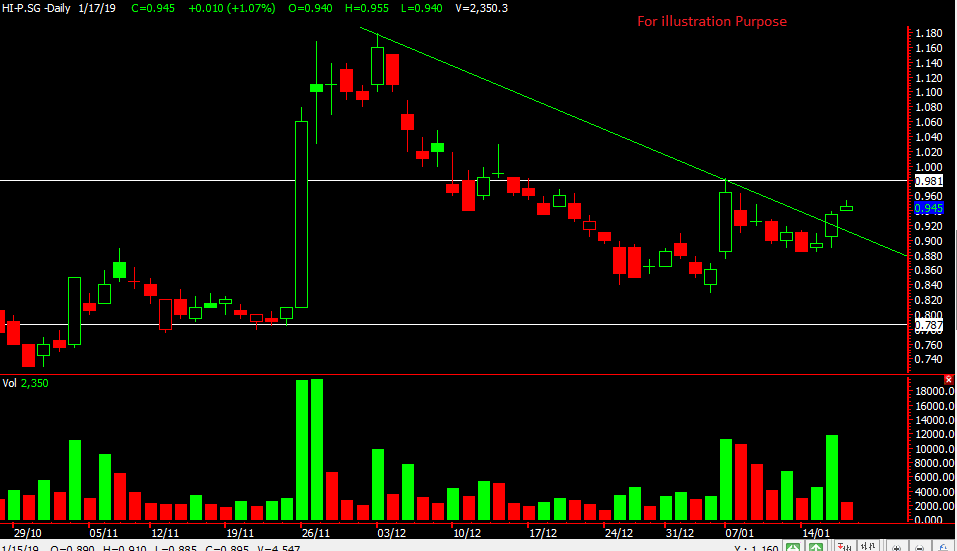

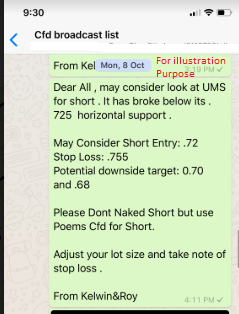

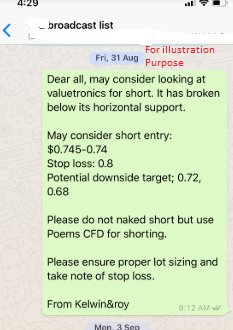

Valuetronics as previously mentioned at $0.75 when it broke below its horizontal support and has came down to our second target of $0.68 this morning. Singapore electronic stocks like Hi-p, UMS, continue to fall with Valuetronics one of the hardest hit today.

Valuetronics even reached to a day low of $0.665 which is a 10% downside since our trade alert to our EXCLUSIVE CLIENTS. A very good trade for just 2 weeks if you ask us. Singapore electronic stocks like Hi-p, UMS, continue to fall with valuetronics one of the hardest hit today.

Staying below the $0.68 support might see it move down to $0.645 where the big run begin. From there we will access the downside again. Remember, step by step, as we plan and prepare for our trades.

Still unsure of how to take advantage of the downside?

Then join us this Wednesday for our CFD seminar where we will be sharing with you how to Use CFDs for shorting to ride this downtrend.

Simply Click HERE to register.

You’ll also be sharing how to join our EXCLUSIVE COMMUNITY to enjoy such trade alerts sent to your handphone straight.

Yours

Humbly

Kelwin&Roy