Chip Eng Seng – [ Using Moving Averages To Our Advantage]

Chart Source: Poemsview 4th March 2019

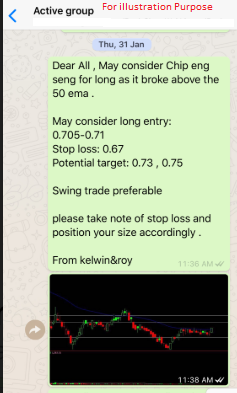

Chip Eng Seng continues its steady climb up to our THIRD Target of $0.77 and got resisted by it temporary. Since our ALERT at $0.705 Chip Eng Seng has seen a 9% upswing in just a month.

Ever since Chip Eng Seng broke above its 50ema it has been hovering and supporting it well before the real move come. Could using such a simple indicator strengthen your analysis to give you that extra boost you need?

As promised if you are interested in knowing how we using the moving average indicator in our analysis then the upcoming workshop is for you.

More details below:

Date: 11 March 2019

Time: 7:30pm

Please register in the link below as we have very limited space.

Yours

Humbly

Kelwin&Roy