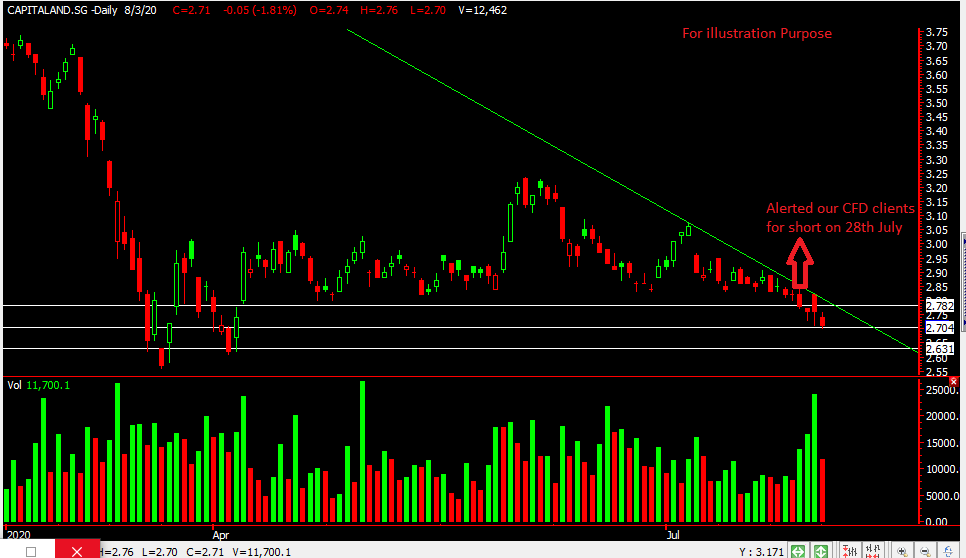

Capitaland – [ Landing On Our First Target, More Downside With Results Around the Corner? ]

Chart Source: Poemsview 3rd Aug 2020

Capitaland together with the other big property counters like UOL and CityDev like we mentioned this morning took a dive today and closed down to near day low.

Property counters and bank counters being part of the STI component, were mainly beaten down bringing the STI down today. Capitaland actually broke its horizontal support back last week of $2.80 and did not have enough strength to regain its footing. We saw weakness when it broke its horizontal and hence alerted our CFD clients for short last week.

We’re glad that Capitaland went according to plan and hit our downside target of $2.70 a nice 3% downside in less than a week. $2.70 might provide some support as its a round number support and also a horizontal support. Failing to hold this we might see our second target of $2.63. Continue watching it!

Want to be part of this EXCLUSIVE GROUP that were alerted of such a trade analysis?

Wait no more! CONTACT US NOW to see how you can be part of this group to receive value added service sent straight to your handphone.

Yours

Humbly

Kelwin&Roy