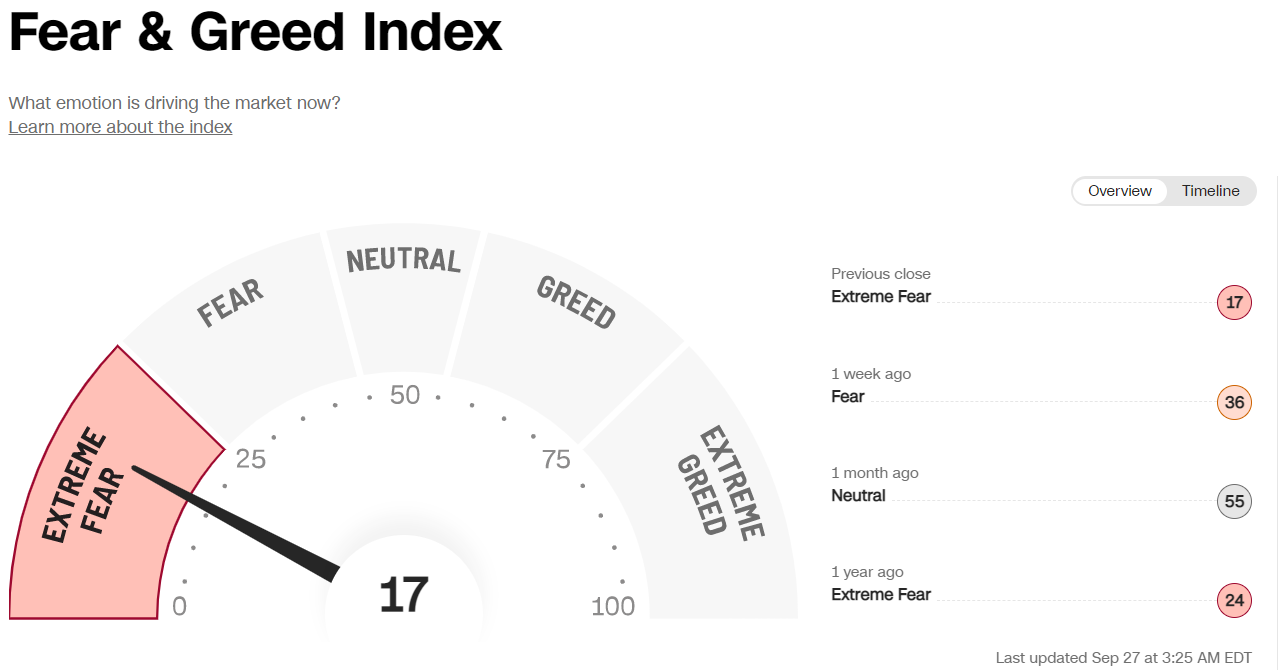

Image credit : https://edition.cnn.com/markets/fear-and-greed

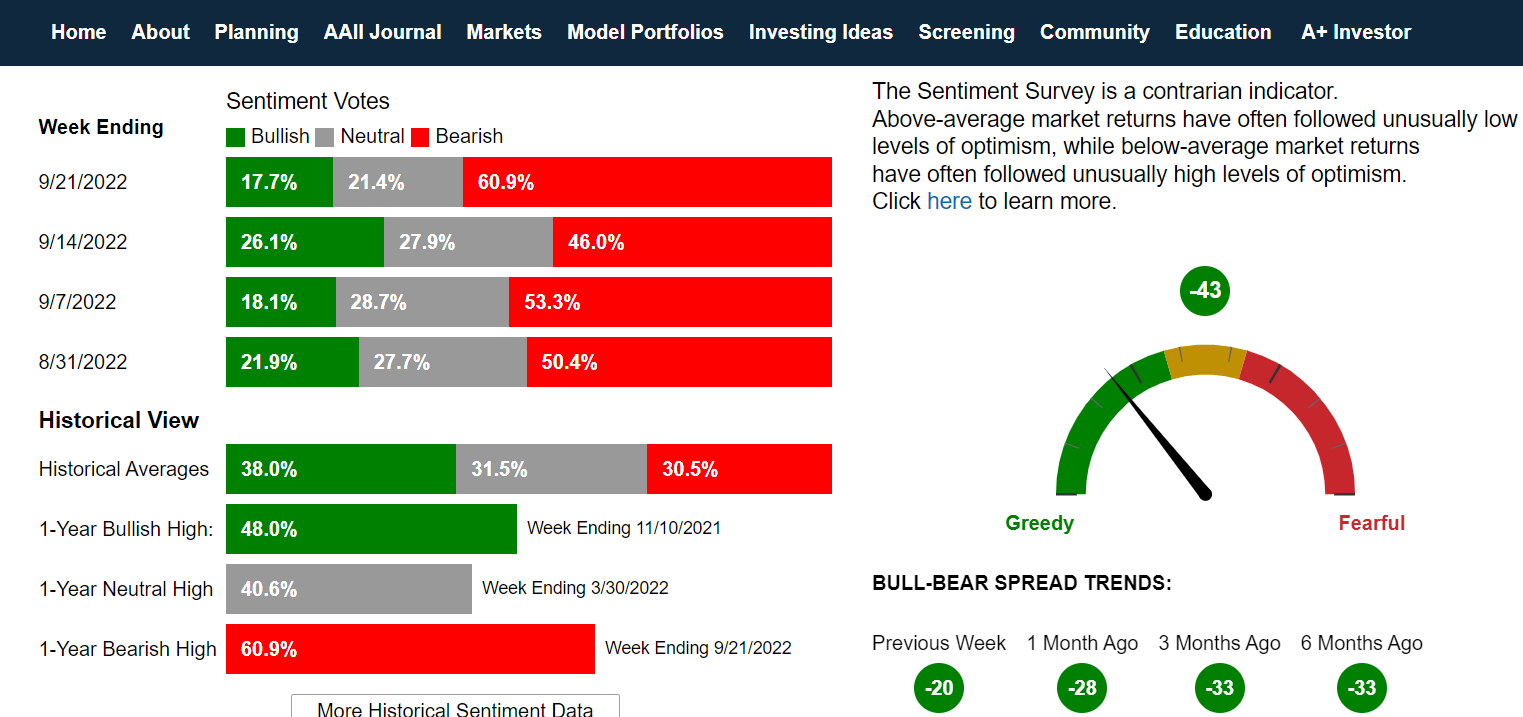

Image credit: https://www.aaii.com/sentimentsurvey

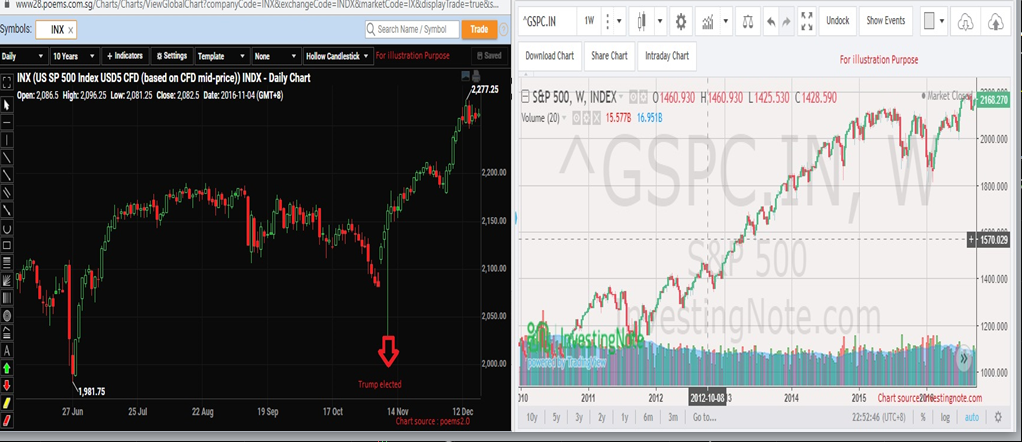

Currency market is going nuts, pound making new low against USD, Jap yen is also at a an all time low while the USD index is strengthening. This together with Fed relentless effort to rein in inflation has caused markets to tumble and fall hard. With fear and volatility at its highest, one would expect even more selling in the market. BUT something we notice that is catching our attention. US markets are actually holding up.

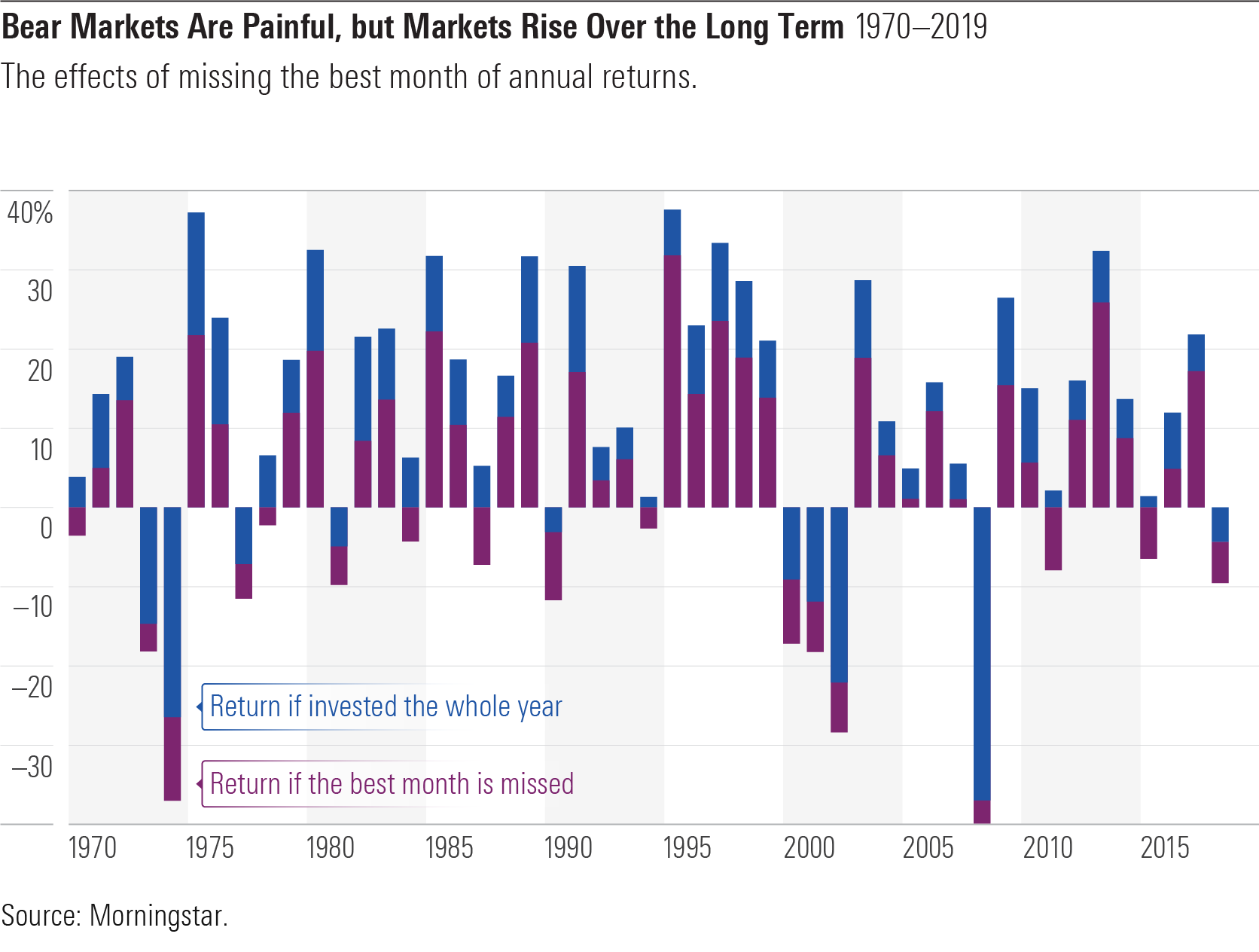

Everyone is eyeing for markets to break June low and maybe a possible fake break before a rebound comes. But for the last two nights, markets has actually been able to hold its support of around 3641, very very close to the June low. With such brutal sell down over the last week we might actually see some rebound coming in. Indicators are currently oversold and yes oversold can remain oversold for an extended period but at least we know we’re not at the top and we might be scraping the bottom. A positive sign is that the rebound is happening at the Friday’s low where is actually tried to rebound from.

We’re watching to see if this support can hold for another session or two and one more thing to look for is the momentum. If market is met with selling, we would see selling with intensity and that’s one sign to see that market is not ready for a rebound. Another note to remember, Oct will also kick start earnings. It may or may not bring cheer to the markets.

What’s your take? How are you positioning yourself?

Yours

Humbly

Kelwin & Roy