City Dev – [ A Bearish Trend Developing? ]

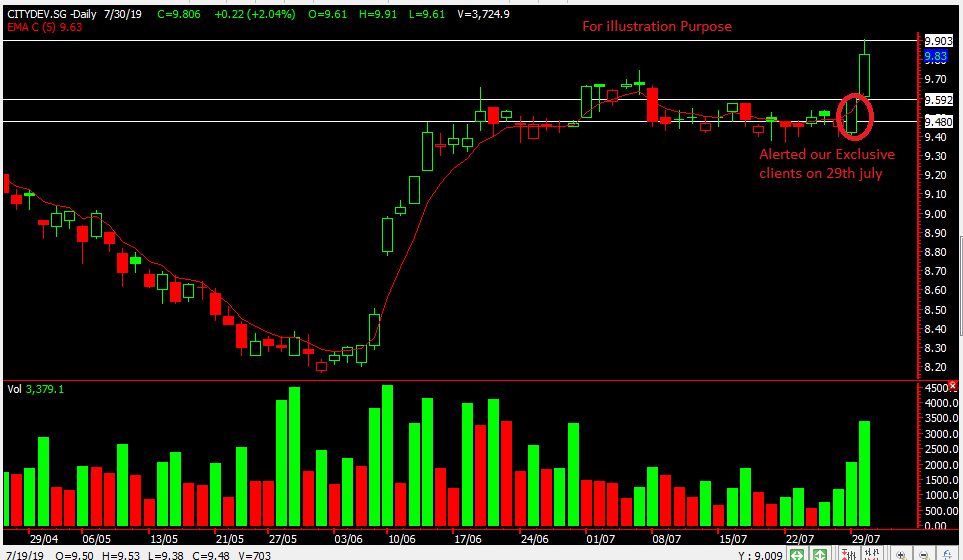

Chart Source: Poemsview 3rd Aug 2020

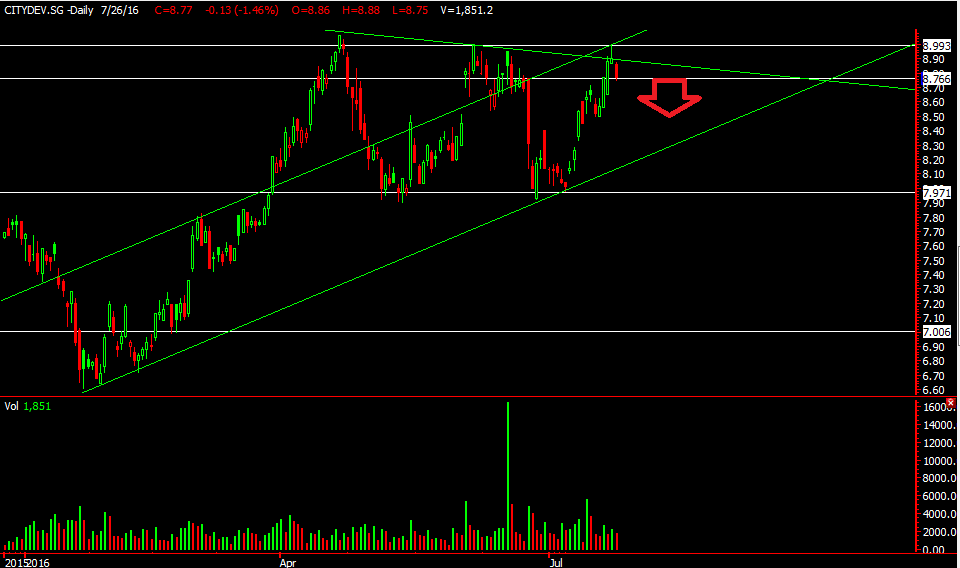

City Dev along with the other big property stocks like capitaland and UOL doesn’t seem to be performing well in the past week. It hasn’t been able to break that downtrend line and is currently resting on the horizontal support line.

With the current Covid situation, property developers might take a hit on all fronts with business slowing down in most sectors. City dev has development in many areas like residential properties, commercial, hotels which could take a hard hit during this Covid period.

If City dev breaks that horizontal support then we might see it move down to the next good support at around $7.65. The resistance would be at the downtrend line and a break above that might signal a good rebound.

Lets watch! We’re looking at more weakness first.

Want to know more about City Dev? Drop us a message!

Yours

Humbly

Kelwin&roy