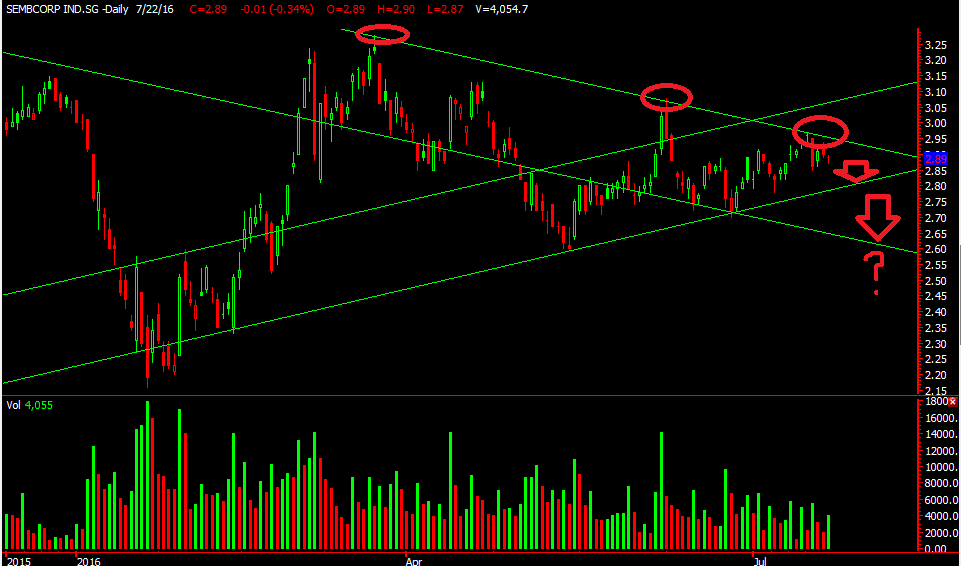

Sembcorp Industries Ltd – More Upside Might Be Possible

Sembcorp Industries is one of the many counters that we are looking out for.

It is currently resisted by the downtrend line that we drew and also by the horizontal resistance line at 3.23 . What we like is that there is an increase in volume, the moving averages seems to be sloping up and the 20ma might be cutting above the 50ma which is a good sign.

Another factor to take note is the upcoming opec meeting on 25th May. Where opec will decide if they will extend the output cut. Oil has been rebounding and that might be positive for our oil counters like sembcorp marine and keppel corp both of which we are looking with interest.

Though sembcorp industries is not a direct oil play. It could potentially benefit from the extension cut.

Our possible entry might be 3.24 with a stop loss of 3.12 and a target of 3.35 first.

Yours

Humbly

Kelwin&Roy