The Omicron variant still dominating headlines as the world comes to grips with this new variant and scramble to try to contain it. There is still much to understand regarding this variant and its still early to that we’re out of the woods.

Some updates on Omicron that we know so far :

- Early Clinical observations globally suggest Omicron Covid-19 variant may have higher reinfection risk.

- Omicron possibly more infectious because it shares genetic code with common cold coronavirus! We’re not doctors but with it being more infectious it might also be less deadly! hopefully this is true and this might not be so worrying!

And with about a week into the news of Omicron markets have slammed down as mentioned in our previous post. In addition to that, Fed has also mentioned about quickening their tapering program! These mix caused the markets to tanked BUT there are some interesting opportunities lying around the corner.

In fact, the greed and fear index is actually almost at the extreme fear side which might spell some opportunities for the sharp eye! This is by no means an indicator to buy but if you observe from past history whenever the Fear & Greed hits the extreme, market tends to rebound. A SANTA rally could still be possible!

Image source: Money.cnn.com

Quoting from Warren Buffet, “Be fearful when others are greedy. Be greedy when others are fearful.” Look for great companies like APPLE, META, AMAZON, TESLA, VISA and even ALIBABA for opportunities to scale in!

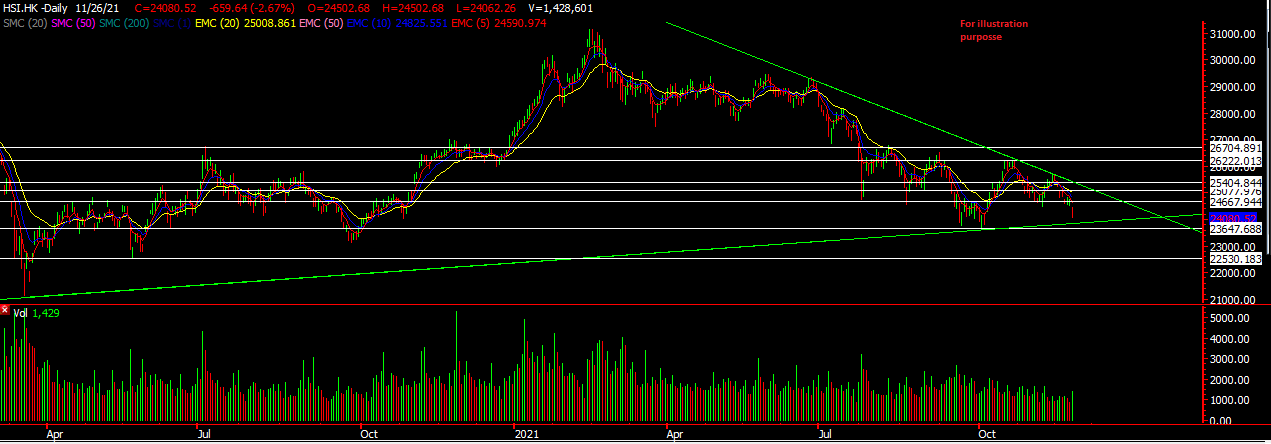

Recap for STI & HSI

As expected both markets has slammed down hard over the week BUT has come to our level of support. Electronic stocks in Singapore gave us a surprise and held up well while the general market shifted into negative territory.

Alibaba took center stage as it continue to move down. Didi has also announced its delisting on the US stock exchange which sparked a sell off on China stocks listed on the US exchange on fear of more delisting.

Technical Levels to Watch For This Week

STI

Our 3033 support held well and we can see STI is trying to rebound and is currently resisted by the 5ema. A break above that might it move to around 3160 level. Downside support at 2994. Banks are leading this rebound.

HSI

HSI has also come down to our support and it does look like it might have some room for rebound. If it can start trading back into that uptrend line then we might see HSI going for a rebound in the near term, if not our next support level is around 22530.

For more analysis on the US market , you can click HERE!

Have a good week ahead!

Yours

Humbly

Kelwin&Roy