Market Outlook

THIS IS WORRYING

Chart Source: Tradingview.com

Debt Ceiling is the talk of the town these days and markets seem to be moving in tandem with news concerning the negotiation of the debt ceiling.

THIS IS the ? ?MOST WORRYING THING that could come out from the debt ceiling drama and ITS NOT the government shutting down!

It happened back in Aug 2011 and the markets came off around 15% .

Will it happen again this time and what to do and how to prepare yourself IF IT happens? ?

We’ll talk more about it during our webinar next Wed at 8pm. ⬇️

Link below to register :

https://bit.ly/SHSjunewebinar

From Kelwin & Roy

January Is Coming To An End, How Have You Fared So Far?

We got another 2 more days till the end of Jan and as we wrap up the first month of 2023 it is also good to ask yourselves how have we done so far? Still struggling to find a footing in the markets? Unclear about where to invest or should we even invest in 2023?

Then good news, we’re here to shed some light and be a guide.

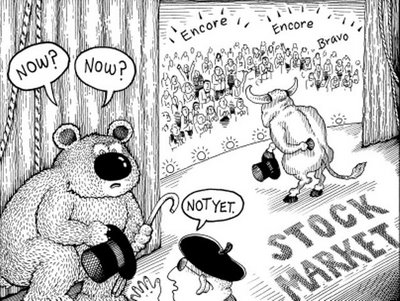

If you have been following us for some time, you would have known that we were bullish on HK/China for the past year and with China opening up, the markets have gone mad! Is there still room for upside? Is it too late to get in or has the engine only started? Are we still bullish on HK/China?

Will the world economy go into a recession or will we be able to avoid it with China opening up? Will the US crash again?

Many questions might be on an investor’s mind and we’ll take time to answer all these in our upcoming webinar next Tuesday.

So if you want to stay ahead of the markets, get some insights on the markets and see where you could possibly grow your funds then this webinar if for you!

Date: 31st Jan ( Tuesday)

Time: 8-9:30pm

Link to register

https://us02web.zoom.us/meeting/register/tZEpceiupzspG9eVbgEw0Wa9EWgBSvQzehvK

See you there!

Yours Humbly

Kelwin & roy

Market Outlook & Sharing Engagement for Second Quarter 2018

Awesome April as some traders might have describe it.

April a traditionally good month for equities made no exception this year as our Straits Times Index moved up over 8% in this April from March. This observation was posted on our blog at the start of April for all to read and

orientate themselves better.

Did you position yourself for the rebound in April or was caught on the other end?

Oil and Banking sector had one of the strongest rebound but will it continue?

Now that April is over, what will the coming months entail?

Soccer World Cup is around the corner and what will happen to the market then?

How should You position yourself? And what sectors should we be looking at?

If you’re searching for answers then come 23rd May. Let our Top Tier Remisiers from Phillip Securities: Kelwin&Roy answer them for you.

With over 16 years of combined experience and numerous awards under their belt with the most recent being awarded the Top 10 Trading Representives in Phillip Securities, they bring their candid and simple sharing to everyone.

Using simple technical analysis, they have spotted the rebounds for the past few months as documented in their blog without any hindsight. For instance, during their client’s 1st Qtr market outlook seminar on 27th Feb they analysed that STI would be supported at 3340 which indeed STI bottomed out on 4th Apr with a day low of 3338 before rebounding and successfully retesting Jan’s high, which was again analysed on their blog on 18 Apr with STI reaching a new 10 Year high at 3641 in early May.

Come 23rd May and they will be sharing their market outlook in the coming months, the sectors to be looking at and also how to join their Vibrant Community of traders.

And for the first time ever they will be opening this event to the Public for their Insightful Quarterly Market Outlook Event.

Wait no more to secure your seat at https://www.eventbrite.sg/e/market-outlook-sharing-engagement-for-second-quarter-2018-tickets-45860351546