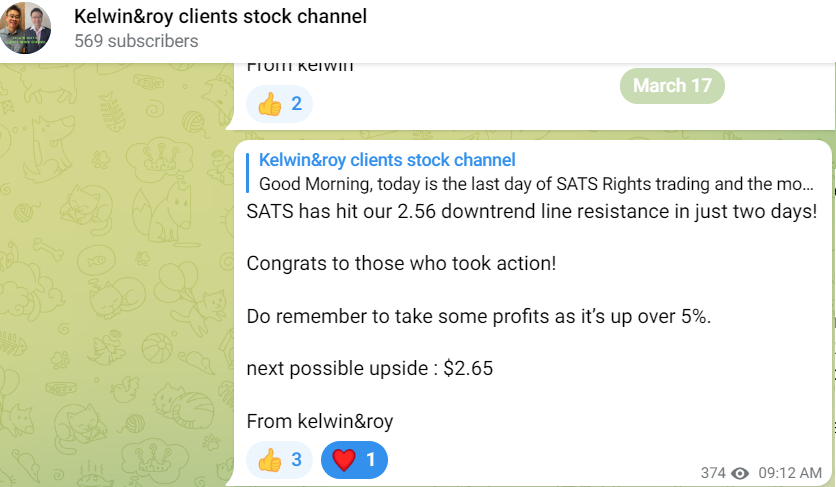

SATS has recently been grabbing the headlines due to their rights and it has also attracted the interest of traders. As the trading of rights were coming to a close two weeks back, we saw an opportunity for a rebound as the rights overhang starts to fade and the recovery of the stock price starts to come into play. So when SATS was trading around the $2.40 range, with a good support there, we alerted our clients about this potential trade set up.

Fast forward two weeks later and we can see SATS has risen by 10%! If you missed this trade then the next question is could should I chase this trade or wait? Let’s take a look at the chart and do a quick analysis.

From the chart, SATS broke out from its downtrend line with higher volume which is a healthy sign. But it was unable to break above its $2.64 resistance and hence might need some time to overcome this. Once this level is taken out then we might see SATS moving up towards the $2.72 then $2.80 upside resistance. Now that the rights issue is out of the way, a general recovery could come into play.

Yes, you might be a little later in the trade but if you want to get in earlier, then ensure that you’re our client to receive such alerts as soon as possible to make that difference!

Just Contact Us Straight Over HERE to learn how you can be receiving such alerts!

Yours

Humbly

Kelwin & Roy