Poems Oil CFD – [ How To Get Started!]

Image source: axiory.com

Oil be it WTI or Brent has seen a gradual increase for the past year ever since it hit its historical zero! With more and more vaccines coming into play, economies are slowly recovering and sentiments are improving.

Always been wanting to trade oil but not sure how to?

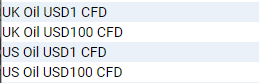

Introducing our brand new commodities CFDs, UK Oil CFD & US Oil CFD! We are offering both Oil CFDs in 1USD and 100USD contracts which allows for greater flexibility!

UK Oil CFD (Brent)

UK Oil CFD tracks the spot price of Brent Crude.Taking up roughly two-thirds of the world’s crude contracts, Brent Crude is the most widely used benchmark for oil. Brent Crude is produced near the sea and is light and sweet which makes it ideal for refining diesel fuel and gasoline.

US Oil CFD(WTI )

US Oil CFD tracks the spot price of West Texas Intermediate (WTI).

West Texas Intermediate (WTI) refers to oil that is extracted directly from the wells in the U.S. It is produced in landlocked areas which makes transportation difficult thus more expensive. WTI is the main benchmark for oil consumed in the United States.

What you might be missing out if you’re not trading oil!

- Most valuable resource in the world. Crude oil is the primary source of energy in the world.It is black gold or the “blood” of world economies. As much as 80% of a barrel of crude is refined into gasoline, jet fuel and distillate fuels such as diesel and heating oils. The rest is processed into petrochemical feedstocks, waxes, lubricating oils, asphalt and other by-products that make their way into thousands of everyday products such as vitamin capsules, tyres and plastics.

Since the start of COVID-19, oil prices have plunged. Demand has shriveled because of pandemic lockdowns and travel restrictions. Of late, prices have partially rebounded. If you are wondering whether it is a good time to enter the oil market, read on as we explain why we think oil should be in every trader’s portfolio!

- High Liquidity .Crude has always been one of the most highly-traded commodities in terms of volume and open interest.

- Pent up Demand for oil. With the UK being the first country to approve the use of COVID-19 vaccines [2], the outlook for the global travel industry has started to look positive. As early as March 2021, pent-up demand for both domestic and global travel could be a powerful catalyst for refineries and airlines to restart oil hedging to lock in future prices. International travel is expected to pick up as borders gradually reopen. It is widely perceived that ‘peak oil’ [3] is not here yet. Pent-up travel demand from a widespread success of COVID-19 vaccinations may further increase crude-oil volatility. This makes it an even more compelling trading tool!

- Portfolio Diversification. It is wise to have a diversified portfolio and not put all your eggs in one basket.

If you’re interested in learning more or are keen to trade oil. Feel Free to drop us a message or you can open a trading account to get access to our Poems CFD.

Do ensure you understand the risk of trading CFDs and as usual, if you want to know more just drop us a message.

Yours

Humbly

Kelwin&Roy