Gold – [ What Are The Ways To Invest In It?]

In Part 1 of our gold series we covered some fundamental aspect of gold and where gold prices might be heading to.

In Part 2 we’ll cover how to invest or trade in gold. How to use CFDs to gain exposure to gold and using cash to buy gold ETFs

GOLD CFDs

If you want to use CFD to trade gold these are some of the gold related products that are available on poems.

CFD allows you to long or short Gold with just 20% margin and participate in the price movement of the underlying Spot Gold directly with minimal capital and costs. Besides Spot Gold, CFD also offers other gold-related securities such as gold miners and various ETFs.

Our Thoughts : Using CFD is usually more for traders who want to take a speculative position on gold. Taking advantage of the volatility of gold being able to long or short gold. For long term investors we would consider other ways to buy gold. So do remember your time horizon in choosing the right instrument to express your view.

GOLD MINERS ETFs

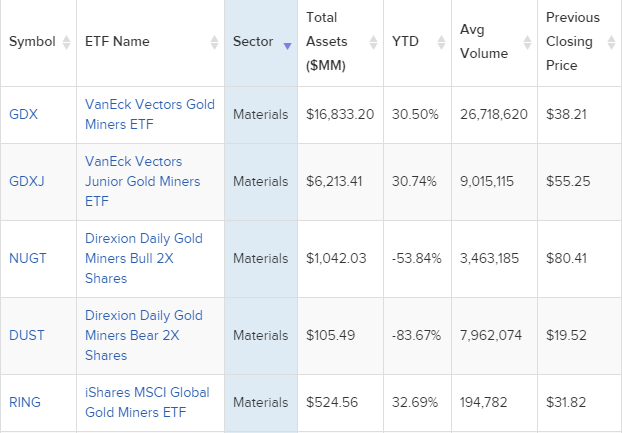

There are around 10 Gold miners ETFs with some having up to 2 times leverage.

The VanEck Vectors Gold Miners (GDX) exchange traded fund is the most liquid vehicle for investors and traders to gain exposure to gold mining companies.GDX tracks the performance of the New York Stock Exchange (NYSE) ARCA Gold Miners Index. Its holdings include most major gold miners listed in the United States and Canada.

VanEck Vectors Junior Gold Miners ETF (GDXJ) tracks the overall performance of small-capitalized companies that are involved in gold mining.

Direxion Daily Gold Miners Bull 2X Shares (NUGT) gives you 2 times leverage on the gold miners whereas

Direxion Daily Junior Gold Miners Index Bull 2x Shares (JNUG) gives you 2 times leverage on the junior gold miners.

Do note that leveraged ETFs are not suitable for novice investors as losses will be magnified as well. Furthermore, leveraged ETFs are not meant to be held long term as the daily rebalancing will cause the value of the investment to erode over time.

Source: etfdb.com

Our Thoughts : If you ask us we would look at the the biggest gold miner (GDX) ETF just to be safer. Gold miners are riskier to us, as investors have to be mindful of gold prices as well as the mining industry. As its lifetime performance shows, a rising gold price does not necessarily mean that GDX will also rise. When gold prices fall, it is most likely that GDX would decline. However, there might be times when GDX can deliver better returns for investors by outperforming gold price itself. We might skew towards the next category which is Gold ETFs.

GOLD ETFs

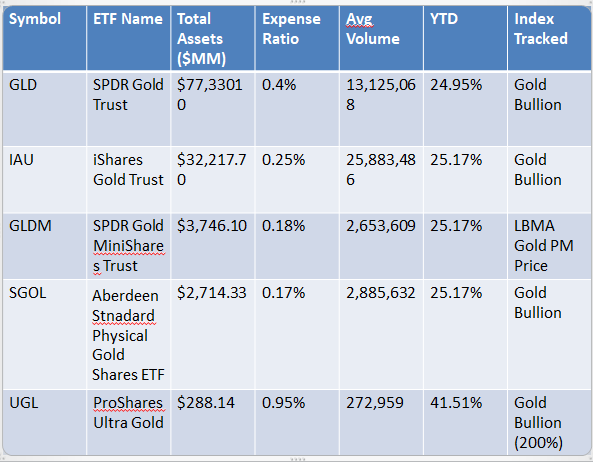

There are a variety of Gold ETFs which can be traded on the US , UK and even on the SGX!

- Let’s start with the largest in the world ,SPDR Gold Trust (GLD) this can be bought on the SGX or AMEX.Total assets :$77,330.10M. Expense ratio: 0.4%. Commodity exposure : physically-backed tracking gold bullion

- iShares Gold Trust(IAU).Total assets : $32,217.70M. Expense ratio: 0.25% .Commodity exposure : physically-backed tracking gold bullion

- SPDR Gold Minishares Trust (GLDM) has one of the lowest expense ratio at 0.18% but it tracks the LBMA ( London bullion Market Association)

- Aberdeen Stnadard Physical Gold Shares ETF (SGOL), expense ratio at 0.17 . Physically-backed tracking gold bullion

- ProShares Ultra Gold (UGL). This is 2 times leverage with an expense ratio at 0.95%. As you can see from the table below, the performance is almost double due to its leverage.

Our Thoughts: We prefer investing into the Gold ETFs as compared to Gold miners etfs or even the gold miners. One reason would be that if gold prices fall, miners usually take a bigger hit and we’re of a more conservative approach. Of course no investment if perfect, in some sense you are always forced to make compromises between risk and reward. SPDR Gold Shares, or a similar gold-owning ETF, will allow you to participate if gold rallies. The trade-off is that you’ll give up the upside potential of owning miners leveraged to the precious metal’s price. A word of caution the average investor should avoid buying leveraged gold ETFs — these use financial derivatives and borrowed money to make bets on future price movements.

Lastly, remember to have cleared ur CAR/CKA as these are considered SIPs which require investors to have the relevant knowledge or experience to understand the risks and features of the SIPs before transacting

Do reach out to us if you would like to discuss more and we’ll be glad to walk you through this.

Yours

Humbly

Kelwin&Roy